Company Formation & Business Setup in Dubai Airport Freezone DAFZA

Easy Business Setup in DAFZA with the Best Business Consultants in UAE.

ABOUT

What is

Dubai Airport Free Zone?

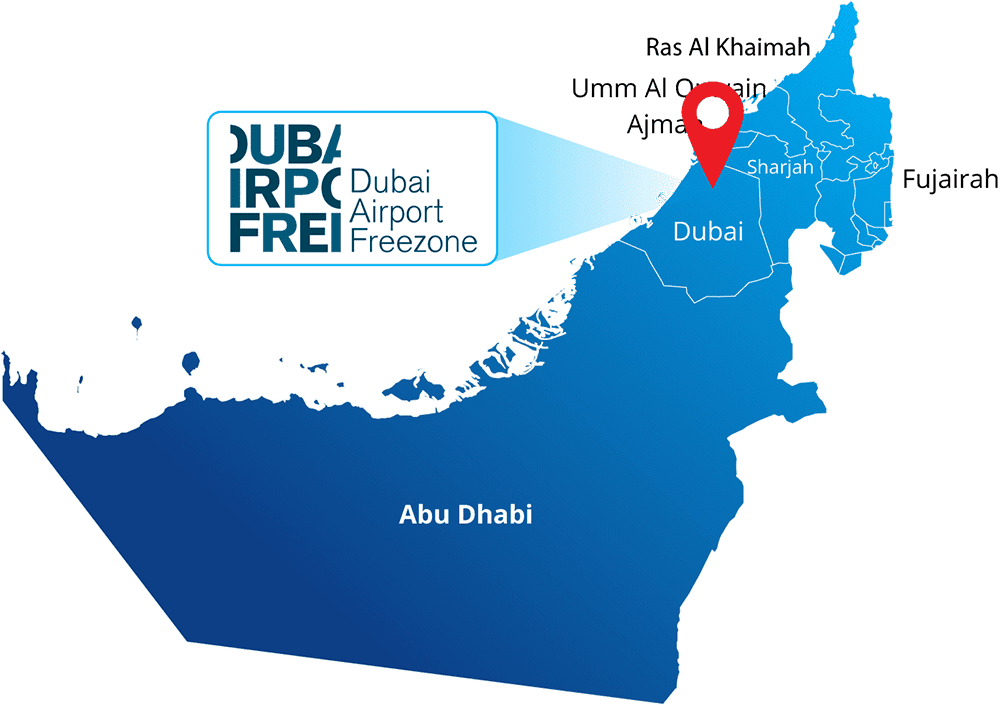

Dubai Airport Free Zone Authority (DAFZA) is one of the many free trade zones that you can find in the UAE. This location is right next to the Dubai International Airport. DAFZA is among the most prestigious & advanced business locations where local and international investors can set up businesses. As a matter of fact, this famous free zone is home to more than 1,800 registered companies. And these businesses operate with more than 18,000 professionals in over 20 different sectors and industries in this location. In fact, DAFZA is famous for providing excellent facilities and services to these many businesses, which is why it keeps growing every day.

PROCESS

How to Setup Your Business in DAFZA?

Choose the business license

Choose the legal structure of your company

Select the space

Submit Documents

Start operating your business

Get Started

Fill the form and book a free consultation with us.

DOCUMENTS

Documents for Business Setup in DAFZA

- Your application form and letter of Intent.

- A copy of the manager’s passport along with the CV.

- Copies of shareholders’ passports and CVs.

- Original bank reference letter for each shareholder.

- A NOC (No Objection Certificate) letter by the current sponsor for the manager.

- All initial approvals from the pertinent authorities if it’s about the business setup of a company related to media, IT, or other particular sectors.

DUBAI AIRPORT FREE ZONE

Business Licenses for Business Setup in DAFZA.

General Trading License

This license allows you to perform the same activities as the trade license. However, it allows you to trade a wider range of goods and products.

Service License

This one is a tailor-made license for companies that offer services instead of products, like those companies that provide IT services.

Industrial License

With this other license, you can perform industrial activities, such as manufacturing, packaging, assembling, and more.

If you carry out your business activities online, this is the license that you need.

BENEFITS

Benefits of Having Business Setup in DAFZA.

- 100% ownership of your business

- Multiple tax incentives, which include full exemption from corporate and income taxes.

- You can get multiple visas without having a physical office space

- Full repatriation of capital and profits

- No minimum share capital is needed to establish a company

- No personal or corporate income taxes

- You can sponsor your dependents easily

- No currency restrictions

- Some of the available facilities that you can get in DAFZA are Flexi-desk spaces, storage areas, executive offices, warehouses, and more.

- Easy to trade with companies in the UAE and the rest of the world

Allowed types of companies in DAFZA

There are many types of company structures that you can choose from during the Dubai Airport Free Zone company formation process. For example, these are the main entities that are allowed in DAFZA:

Free Zone Company (FZC)

Requires at least 2 shareholders and up to 50 shareholders.

Branch of an Existing Company

Minimum share capital is not a requirement. Besides, the branch office can belong to a local or a foreign company.

Public Limited Company (PLC)

Perfect for companies that offer their shares (IPO) on a securities market. There are no limits on shareholders.

The DAFZA company setup cost will depend on several factors, such as your chosen license and office space for rent. However, packages are subject to availability and changes. Furthermore, you must take into consideration other important expenses. And some of the fees that you must cover are the following:

- Office area.

- Rent (which includes service charge).

- License fee.

- The registration fee.

- Postal fee.

- Establishment card.

- Memorandum of Association fee.

- Parking fee (it is optional).