Company Formation & Business Setup in Umm Al Quwain Freezone (UAQFZ)

Easy Business Setup in Umm Al Quwain Freezone with the Best Business Service Providers in UAE.

ABOUT

What is

Umm Al Quwain Freezone?

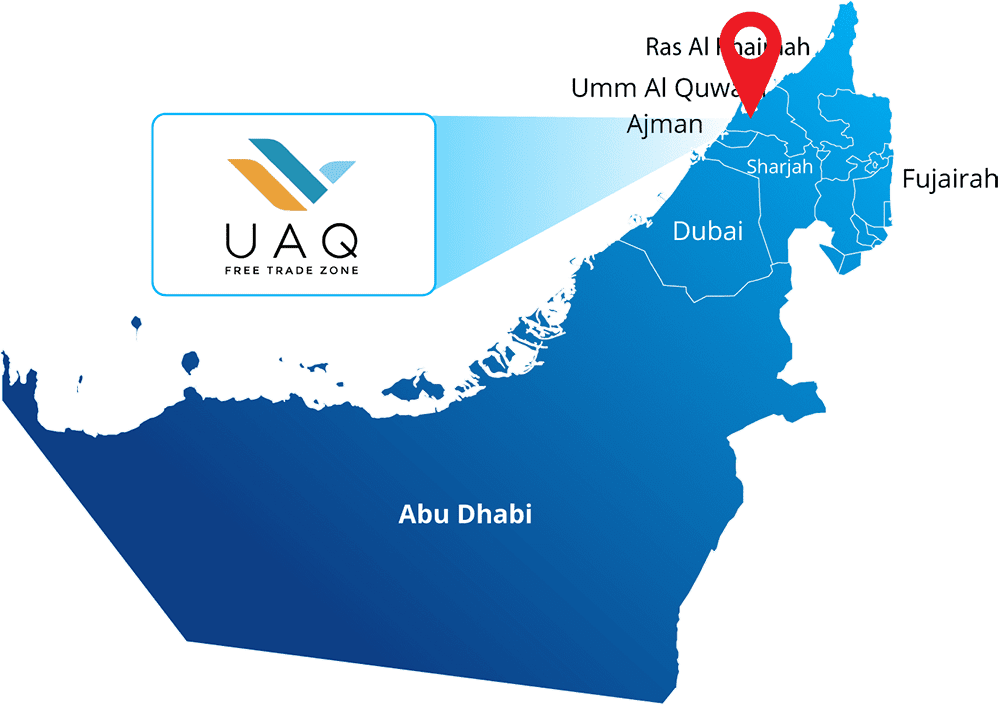

Umm al Quwain Free Zone is a great place when it comes to businesses. UAQ has a strategic sport in the UAE and is one of the best places for establishing your company. It’s a place that receives foreign investors and it’s leading in global trading.

There are several big industries that have set in UAQ its home for carrying out their business activities. Due to its stable economy, great location and tax benefits, investors and entrepreneurs can find in this place a smart choice for setting up a business that provides outstanding results.

PROCESS

How to Set Up your Business in Umm Al Quwain Freezone

Get Started

Fill the form and book a free consultation with us.

DOCUMENTS

Documents for Business setup in Umm Al Quwain Freezone

- Your application form and letter of Intent.

- Passport copies of each shareholder.

- Lease contract

- Business plan

- Copies of shareholders’ passports.

- Copy of trade license (for a branch company)

- NOC for UAE residents from the sponsor (if applicable).

Umm Al Quwain Freezone

Business Licenses for Business Setup in Umm Al Quwain Freezone

Trade License

This license allows you to perform the same activities as the trade license. However, it allows you to trade a wider range of goods and products.

Consultancy License and Service License

It should be obtained by businesses that offer professional advice and expert assistance. Craftsmen and artisans fall under this license. On the other hand, it is for businesses that provide a service like couriers, car rentals, tours, and more.

Freelance Permit/License

The Freelance Permit is for individuals that can conduct business by offering a service with their birth name. The activities covered under this license are media, technology, and more sectors.

Premium Consultancy License

Businesses that belong to tourism, real estate, engineering, oil and gas, aviation, legal, financial and investment services should apply for the Premium Consultancy License.

BENEFITS

Benefits of doing business in Umm Al Quwain Freezone

- 100% ownership of your business

- Small businesses can receive many advantages from this place

- You can hire foreign employees for your business

- Cost-effective rental options for office spaces and lands

- Full repatriation of capital and profits

- No minimum share capital is needed to establish a company

- No personal or corporate income taxes

- No currency restrictions

- Easy to trade with companies in the UAE and the rest of the world

Allowed types of companies in UAQFZ.

There are several options for incorporating a business since you have various types of legal structures available. You can choose the best option for you that suits your requirements depending on the business activity & amount of shareholders, a determinate type of entity can be best for you.

Free Zone Establishment (FZE)

An individual or a corporate can establish a Limited Liability Establishment in UAQFZ.

Free Zone Company (FZC)

FZC is a Limited Liability Company that has more than 1 shareholders and up to 50 as maximum.

Branch of a Local Company

Companies registered in the UAE, whether in Mainland or in another Free Zone can establish a branch in UAQFZ.

Branch of a Foreign Company

An international company, which has been incorporated outside the UAE, can establish a branch in UAQFZ to carry out its operations.

Since UAQFZ is a place that welcomes almost all industries, businesses can find the perfect physical space to conduct their operations. It’s important to choose a facility that suits your needs regarding visa eligibility. Some of the best facilities in UAQFZ are the following:

- Hot Desk

- Premium Offices

- Warehouses