The secret formula for business success? It’s hiding in Abu Dhabi.

Science tells us that every thriving ecosystem has a precise balance of elements: structure, resources, and opportunity. Now, imagine a business environment engineered to perfection—where red tape dissolves faster than sugar in hot coffee. This isn’t theoretical. Meet the Abu Dhabi Global Market (ADGM), where one fintech startup turned a lightbulb idea into a regional empire in under three years. Intrigued? Let’s decode why ADGM isn’t just another free zone—it’s your business’s next sandbox for UAE free zone company formation.

Introduction to the Abu Dhabi Global Market

Established in 2015, this international financial hub combines regulatory muscle with the agility of a startup. Unlike traditional setups, ADGM operates under an independent common-law framework, offering businesses a familiar, transparent legal system. Here, ease of doing business isn’t a buzzword. It’s baked into everything from licensing to profit repatriation. Whether you’re a fintech innovator or a consultancy wizard, ADGM rolls out the red carpet, minus the corporate pomp. 100% foreign ownership and zero-tax policies make it a magnet for global players.

The right business environment isn’t just about location; it’s about leverage. In this world of corporate setups, Abu Dhabi Global Market is the kind of leverage that turns business potential into performance.

Nestled in UAE’s capital, the free zone isn’t just another spot on the map. It is a full powerhouse of regulatory excellence, financial expertise, and global connectivity.

So what’s in it for entrepreneurs, investors and businesses seeking UAE free zone company formation?

An atmosphere that competes with the best financial hubs worldwide. International standards meet UAE efficiency, think of this kind of setup.

From emerging startups looking for a robust financial system to multinational companies expanding in Middle East, ADGM provides the platform to operate at a global level.

Location and Significance

Nestled on Al Maryah Island, ADGM sits at the crossroads of Abu Dhabi’s financial heartbeat and global trade routes. Its neighbors? Think global banks, Fortune 500 HQs, and luxury hotels where deals are sealed over karak chai. While free zones in Dubai often steal the spotlight, ADGM’s strategic location offers something distinct: proximity to Abu Dhabi’s sovereign wealth funds and policy influencers.

Translation: If your business thrives on connections and credibility, this is your backstage pass. Plus, with a 10 minute drive from Abu Dhabi International Airport, your next investor could land before your coffee cools.

Compared to some free zones that cater primarily to logistics or trading, ADGM is built for finance, fintech, asset management, and professional services.

Being in the UAE’s capital also means direct access to:

- government agencies

- multinational firms

- sovereign wealth funds

The region boasts an extensive network of business-friendly policies, international connectivity, and a thriving financial ecosystem. In short? You’re not just setting up a company. What you are plugging into is the financial nerve center, connecting UAE with global markets.

Excellent infrastructure, cutting edge tech, and premium office spaces, ADGM supports startups and established enterprises. Businesses operating here benefit from proximity to international banks, financial regulators, and high net worth investors. Plus, ADGM is a prime location for businesses to develop pioneering solutions in finance and technology, thanks to the culture of innovation here.

Legal Framework and Authorities

A free zone is only as good as its regulations, and ADGM sets the gold standard.

ADGM’s legal framework is the Clark Kent of business setups—unassuming but superpowered. Governed by its own Registration Authority, Financial Services Regulatory Authority, and Courts, it operates similar to a mini jurisdiction in UAE.

The best part? No need to decode legal hieroglyphics. Contracts here are enforceable globally, and disputes are resolved in English under common law. It provides a transparent and predictable legal system that international investors trust. That means:

- No ambiguity when it comes to contracts, disputes, or corporate governance

- A fully independent judicial system led by seasoned international judges

- Regulations aligned with global best practices, making cross-border dealings smoother

- Comprehensive compliance frameworks ensuring adherence to international financial policies

Need a business trade license? ADGM offers three flavors: commercial, professional, and financial. Each comes with tailored perks, such as streamlined banking or access to fintech sandboxes.

Business Ecosystem and Industry Focus

ADGM isn’t a one size fits all free zone. It’s a curated ecosystem for sectors like fintech, renewable energy, and digital assets. Picture a LinkedIn feed come to life: incubators, venture capitalists, and regulators all mingling at rooftop networking events.

The zone also offers operational substance support—think virtual offices, flexi-desk spaces, and visa services that won’t make you want to pull your hair out. Bonus: Their digital onboarding lets you launch a company faster than you can binge a Netflix series.

ADGM isn’t just a free zone. It’s a business playground for high-caliber industries. While many free zones in Dubai cater to general trading, ADGM specializes in sectors that thrive on regulatory precision and global trust. These include:

- Banking & Finance

(Home to investment banks, insurance firms, and private equity houses.) - Fintech & Innovation

(With regulatory sandboxes and tech-friendly policies, it’s a fintech hub like no other.) - Asset & Wealth Management

(A hotspot for hedge funds, family offices, and investment advisory firms.) - Professional Services

(Law firms, consulting agencies, and corporate service providers all thrive here.)

Further enhancing its reputation as a trusted business center, ADGM has established partnerships with international financial institutions and regulatory bodies.

Startups and scale-ups in fintech benefit from:

- tailored support programs

- incubation initiatives

- access to venture capital networks

Innovation is constantly promoted by the free zone through:

- Accelerator programs

- Workshops

- Collaboration initiatives with global financial players

Comparison with Other Free Zones

Yes, Dubai’s free zones are shiny. But ADGM plays chess where others play checkers. Take Dubai’s DIFC: Both target finance, but ADGM’s common law system appeals to firms eyeing global arbitration. Compared to DMCC’s commercial license in UAE options, ADGM leans into niche sectors of crypto and sustainability.

And let’s talk about taxes. All UAE free zones offer zero income tax. ADGM throws in no customs duties and a double taxation avoidance network spanning 137 countries!

Wondering how ADGM stacks up against other UAE free zone company formation options? Here’s a quick comparison:

| Feature | ADGM | Other Free Zones |

| Legal System | English Common Law | UAE Commercial Law |

| Industry Focus | Finance, fintech, professional services | Trading, logistics, general business |

| Regulatory Oversight | Internationally recognized | Varies by free zone |

| Business Ownership | 100% foreign ownership | 100% foreign ownership (varies) |

| Licensing Process | Streamlined, transparent | Dependent on free zone |

For those in finance, fintech, or professional services, ADGM is a no-brainer. Its regulatory environment and global credibility give it a competitive edge over other commercial license in UAE options. The structured legal and financial environment ensures seamless operations for businesses aiming to scale internationally while maintaining compliance with the highest standards.

Check More Business Setup Guidelines

Skip the frustration: Partner with experts who’ve cracked the code. From drafting MOUs to securing visas, the right guide turns bureaucratic hurdles into speed bumps.

ADGM’s checklist is your blueprint for credibility. Miss a step, and you risk delays. Nail it, and you’re the master of efficiency.

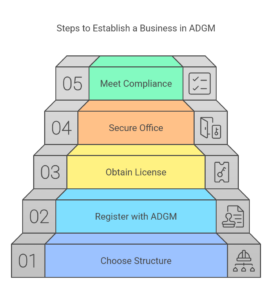

Starting your business in ADGM requires careful planning. Here’s a simplified roadmap to get you started:

- Choose Your Business Structure – Decide between a limited company, partnership, or branch office.

- Register with ADGM – Submit your application, including your business plan and shareholder details.

- Obtain a Business Trade License – Ensure compliance with industry regulations.

- Secure Office Space – Physical or virtual offices are available based on your business model.

- Meet Compliance Requirements – Keep up with tax filings, audits, and regulatory obligations.

ADGM offers a dedicated one-stop-shop portal, allowing businesses to handle licensing, visas, and other administrative processes seamlessly. Additionally, companies can benefit from a range of government incentives, making it easier to scale operations efficiently. Entrepreneurs also have access to business mentorship, networking events, and investment forums that drive growth and long-term success

FAQ

Q: How long does UAE free zone company formation take in ADGM?

A: As little as two weeks if your documents are perfectly organized.

Q: Can I get a physical office space?

A: Yes—choose from sleek towers or virtual setups that scream professional without the lease drama.

Q: What’s the difference between a trade license and a commercial license?

A: Trade licenses cover specific activities (e.g., retail), while ADGM’s commercial license in UAE free zones is broader, ideal for services and consulting.

Conclusion

The Abu Dhabi Global Market isn’t for everyone. It’s for visionaries who want their cake (tax exemptions) and eat it too (global credibility). Whether you’re testing blockchain waters or launching a boutique consultancy, ADGM offers the infrastructure, legal clarity, and swagger to make competitors sweat.

Claim your slice of this tax-friendly oasis. The only thing standing between you and ADGM’s skyline is a Go decision. Time to make it.

Setting up a company in Abu Dhabi Global Market is about establishing credibility and gaining access to a financial powerhouse. Whether you’re a startup, an established enterprise, or an investor looking to expand, our UAE free zone company formation services make the process smooth.

With a simple setup process and a thriving business ecosystem, ADGM is the destination for companies that want to operate on a global scale.

Why waste time on bureaucracy when you could be growing your business? Let’s get your ADGM company up and running—efficiently, legally, and with zero hassle. With the right support and guidance, you can avail many opportunities in this dynamic financial hub.

Contact us now for our services.

Alexander M

![]() Alexander MAlex joined Connect Group as a Document Controller couple of years back.

Alexander MAlex joined Connect Group as a Document Controller couple of years back.

He is in charge of all controlled documents for the company,

making sure everyone is on the same page when they need to be.

He also create, design and maintain the architecture for document

processes and procedures and enforce the proper

chain of action and document identification.

Alex go through all confidential documents and make edits,

updates, and check for accuracy. Once this process is completed,

he will approve the documents and distribute it to the right team.

He also ensures proper labeling, numbering, and

accessibility of the documents to all team members.